| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Noah Holdings Limited (NOAH) operates as a wealth management service provider with focus on distributing wealth management products in the Peoples Republic of China.

Noah Holdings Limited (NOAH) operates as a wealth management service provider with focus on distributing wealth management products in the Peoples Republic of China.

The companys distributed products include fixed income products, including collateralized fixed income products sponsored by trust companies and real estate funds managed that provide investors with fixed rates of return; private equity funds products comprising investments in various private equity funds sponsored by domestic and internal fund management firms, funds of funds and real estate funds, and the underlying assets that are portfolios of equity investments in unlisted private companies; and other products, such as mutual fund products, private securities investment funds that are privately raised funds investing in publicly traded stocks, and investment-linked insurance products.

It serves high net worth individuals; enterprises affiliated with high net worth individuals; and wholesale clients, primarily local commercial banks or branches of national commercial banks that distribute wealth management products to their own clients.

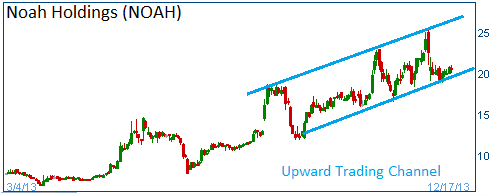

Shares are heading higher in an upward trading channel. Currently, they are near the lower boundary of the said channel.

52-Week Trading Range: $4.90 - 25.51

Entry Point: $20.40

Stop Loss: $19.44

Target Pirce: $22.50

NOAH dropped below our stop loss. We do, however, remain positive on the stock.