| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Euronet Worldwide (EEFT) provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers.

Euronet Worldwide (EEFT) provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers.

The company operates in three segments: EFT Processing, epay, and Money Transfer. The EFT Processing segment provides electronic payment solutions consisting of automated teller machine (ATM) network participation, outsourced ATM and point-of-sale (POS) management solutions, credit and debit card outsourcing, card issuing, and merchant acquiring services; advertising, customer relationship management, currency conversion, mobile top-up, bill payment, fraud management, and foreign remittance payout services; and integrated software solutions for electronic payments and transaction delivery systems.

As of December 31, 2012, it processed transactions for a network of 17,600 ATMs and approximately 67,000 POS terminals in Europe, the Middle East, and the Asia Pacific. The epay segment engages in the electronic distribution of prepaid mobile airtime and other electronic payment products, and provides collection services for various payment products, cards, and services. This segment operates a network of approximately 680,000 POS terminals to enable electronic processing of prepaid mobile airtime top-up services and other non-mobile content in Europe, the Middle East, the Asia Pacific, North America, and South America, as well as distributes vouchers and physical gifts in Europe.

The Money Transfer segment provides consumer-to-consumer money transfer services through a network of sending agents and company-owned stores in North America and Europe; customers bill payment services; payment alternatives, such as money orders and prepaid debit cards; check cashing services for various issued checks; and foreign currency exchange services.

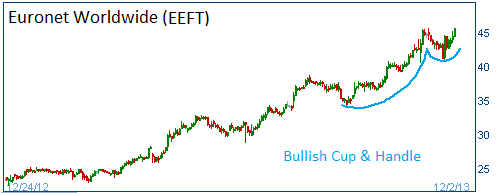

Shares have formed a bullish "cup & handle" and higher share prices are expected for this stock. Note that the recent rate cut by ECB should bode well for financial services stocks.

52-Week Trading Range: $20.30 - $45.63

Entry Point: $45.90

Stop Loss: $43.50

Target Price: $50.35

EEFT closed after its 30-day expired without reaching its target.