| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Netflix (NFLX) provides Internet television network service that enables subscribers to stream TV shows and movies directly on TVs, computers, and mobile devices in the United States and internationally.

Netflix (NFLX) provides Internet television network service that enables subscribers to stream TV shows and movies directly on TVs, computers, and mobile devices in the United States and internationally.

The company operates in three segments: Domestic Streaming, International Streaming, and Domestic DVD. The Domestic Streaming segment offers access to content delivered over the Internet to various connected devices, such as PCs, Macs, game consoles, smart TVs, Blu-ray players, hone theatre systems, Internet video players, digital video recorders, and mobile devices.

The International Streaming segment engages in the streaming services primarily in Canada, Latin America, the United Kingdom, Ireland, Finland, Denmark, Sweden, and Norway. The Domestic DVD segment provides DVDs-by-mail subscription services. The company also provides standard definition DVDs and Blu-ray discs to its subscribers in the United States.

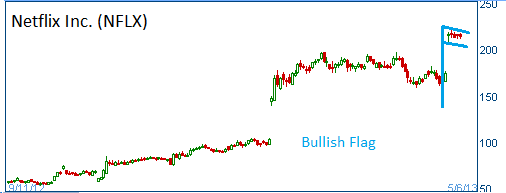

Shars have formed a bullish "flag" after the firm reported earnings that beat estimates and guided higher going forward. Higher share prices are expected for this stock.

52-Week Trading Range: $52.81 - $224.30

Entry Point: $215.00

Stop Loss: $204.25

Target Price: $236.50

NFLX is trading at our stop loss in pre-market due to the news that Rogers Communications plans to offer a service similar to Netflix in Canada. We will keep the position open as we think this is a blimp on the screen for the shares in their way heading higher. NFLX is still heading higher.

We closed NFLX position at $236.50 after it reached our target. If you elect to stay in the stock, adjust your stop loss upward to $234.00