| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Cardtronics (CATM) provides automated consumer financial services through its network of automated teller machines (ATMs) and multi-function financial services kiosks.

Cardtronics (CATM) provides automated consumer financial services through its network of automated teller machines (ATMs) and multi-function financial services kiosks.

As of February 7, 2013, the company owned and operated approximately 62,800 retail ATMs in the United States and internationally. It offers cash dispensing, bank account balance inquiry, and money transfer services, as well as other consumer financial services, including bill payments, check cashing, and remote deposit capture services.

The company also provides various forms of managed services solutions, such as monitoring, maintenance, cash management, customer service, and transaction processing services to operate ATMs and financial services kiosks for its merchant customers. In addition, it partners with national financial institutions to brand its ATMs and financial services kiosks with their logos.

Further, it offers surcharge-free ATM access to customers of participating financial institutions; and owns and operates an electronic funds transfer transaction processing platform that provides transaction processing services to its network of ATMs and financial services kiosks, as well as other ATMs under managed services arrangements.

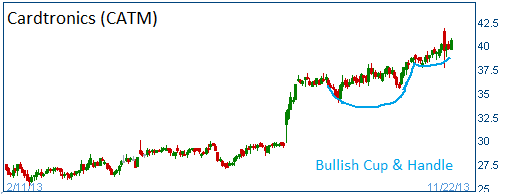

The company reported quarterl results last Monday and beat the estimates. Shares are expected to head higher out of thier bullish "cup & handle."

52-Week Trading Range: $22.20 - $41.82

Entry Point: $40.50

Stop Loss: $38.50

Target Price: $44.60

We are closing CATM position after it failed to reach our target price after 30 days.