| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Cirrus Logic (CRUS) is a fabless semiconductor company.

Cirrus Logic (CRUS) is a fabless semiconductor company.

The firm develops analog and mixed-signal integrated circuits (ICs) for a range of consumer and industrial markets. The company offers audio products, including analog-to-digital converters (ADCs), digital-to-analog converters (DACs), codecs, digital interface ICs, volume controls, adaptive noise cancelling circuits, and amplifiers, as well as audio digital signal processors. Its audio products are used in various consumer applications comprising portable media players, Apple's smartphones, tablet computers, laptops, audio/video receivers, Blu-ray disc players, home theater systems, set-top boxes, gaming devices, digital camcorders, and digital televisions.

The company also provides energy products, which include LED driver ICs, power factor correction ICs, ADCs, and DACs for use in energy-related applications, such as LED retrofit lamps, digital utility meters, power supplies, and energy exploration. Cirrus Logic, Inc. sells its products through direct sales force, external sales representatives, and distributors.

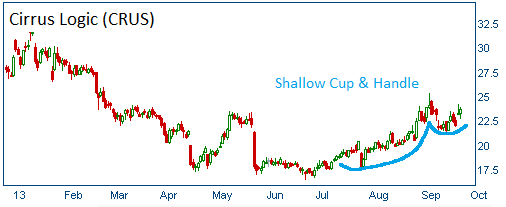

Shares have formed a bullish, shallow "cup & handle" and higher share prices are expected for this stock.

52-Week Trading Range: $16.46 - $42.00

Entry Point: $23.30

Stop Loss: $22.20

Target Price: $25.70

CRUS reached our target price. If you elect to stay in the stock, raise your stop loss to $25 to protect your gains.