| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Apple Inc. (AAPL) designs, manufactures, and markets mobile communication and media devices, personal computers, and portable digital music players; and sells related software, services, peripherals, networking solutions, and third-party digital content and applications worldwide. Its products and services include iPhone, iPad, Mac, iPod, Apple TV, the iOS and Mac OS X operating systems, iCloud, and various accessory and support offerings, as well as a range of consumer and professional software applications.

Apple Inc. (AAPL) designs, manufactures, and markets mobile communication and media devices, personal computers, and portable digital music players; and sells related software, services, peripherals, networking solutions, and third-party digital content and applications worldwide. Its products and services include iPhone, iPad, Mac, iPod, Apple TV, the iOS and Mac OS X operating systems, iCloud, and various accessory and support offerings, as well as a range of consumer and professional software applications.

The company sells its products and services to consumers, small and mid-sized business, education, enterprise, and government customers through its retail stores, online stores, and direct sales force, as well as through third-party cellular network carriers, wholesalers, retailers, and value-added resellers. In addition, it offers various third-party iPhone, iPad, Mac, and iPod compatible products, including application software, printers, storage devices, speakers, headphones, and other accessories and peripherals, through its online and retail stores; and digital content and applications through the iTunes Store, App Store, iBookstore, and Mac App Store.

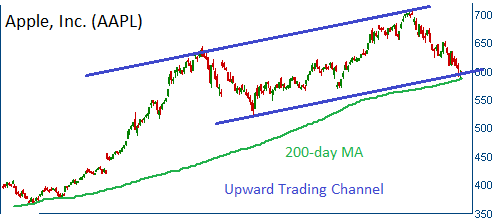

As of September 24, 2011, the company had 357 retail stores, including 245 stores in the United States and 112 stores internationally. Shares have been under pressure and now finding support at their 200-day moving average. This should be a good entry point for this solid performer. Shares are presently at the lower boundary of an upward trading channel.

52-Week Trading Range: $363.32 - $705.07

Last Trade: $598.10

Stop Loss: $568.10

Target Price: $657.80