| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

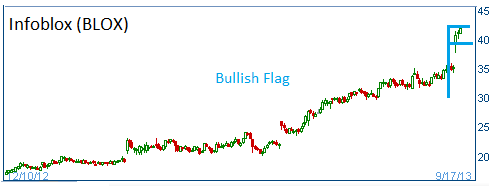

This stock was featured in June 2013 at $30.

Infoblox (BLOX) develops, markets, and sells automated network control solutions worldwide.

Infoblox (BLOX) develops, markets, and sells automated network control solutions worldwide.

Its appliance-based solution combines real-time IP address management with the automation of network control, and network change and configuration management processes in physical and virtual appliances. The company offers Trinzic Enterprise, an appliance designed to ensure the continuous operation of network control; Trinzic IPAM for Microsoft, which provides a Web-based management interface for the centralized management of DNS, DHCP, and multiple IP address pools running on Microsoft servers; Trinzic Reporting that offers reporting, trending, analysis, and tracking capabilities to report network utilization, isolate performance problems, implement DHCP and DNS capacity planning, and identify security threats; and Trinzic IPAM Insight that allows automated discovery of network device configuration information used in automation and compliance reporting.

It also provides Trinzic NetMRI product, which automates network change and configuration management processes; Trinzic Network Automation that automates network configuration functions; Trinzic Network Compliance, which provides monitoring of network devices; Trinzic Switch Port Manager for viewing and managing switches with current and historical IP addresses, MAC addresses, VLAN mappings, and network device topology information; and PCI Insight that monitors PCI DSS compliance and produces compliance reports. The company also provides maintenance and support, consulting, and training services. It serves end customers of various industries, including financial services, government, healthcare, manufacturing, retail, technology, and telecommunications.

Shares have formed a bullish "flag" following its quarterly results. Higher share prices are expected for this stock.

52-Week Trading Range: $13.73 - $42.03

Entry Point: $42.00

Stop Loss: $39.80

Target Price: $46.15

BLOX fell below our stop loss. Position was closed at $39.80.