| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Chart Industries (GTLS) manufactures and supplies engineered equipment used in the production, storage, and end-use of hydrocarbon and industrial gases in the United States, the Czech Republic, China, and internationally. The company operates in three segments: Energy and Chemicals, Distribution and Storage, and BioMedical.

Chart Industries (GTLS) manufactures and supplies engineered equipment used in the production, storage, and end-use of hydrocarbon and industrial gases in the United States, the Czech Republic, China, and internationally. The company operates in three segments: Energy and Chemicals, Distribution and Storage, and BioMedical.

The Energy and Chemicals segment offers brazed aluminum and air-cooled heat exchangers, cold boxes, process systems, and liquefied natural gas (LNG) vacuum-insulated pipes (VIPs) to natural gas, petrochemical processing, and industrial gas companies.

The Distribution and Storage segment provides cryogenic equipment to the bulk and packaged industrial gas markets. Its products include cryogenic bulk storage systems; cryogenic packaged gas systems; cryogenic systems and components, such as VIPs, engineered bulk gas installations, specialty liquid nitrogen, end-use equipment, and cryogenic flow meters; and vacuum insulated bulk liquid CO2 containers for beverage carbonation in restaurants, convenience stores, and cinemas. This segment also offers cryogenic solutions for the storage, distribution, vaporization, and application of LNG; and is involved in the installation, service, repair, and maintenance of cryogenic products, such as storage tanks, liquid cylinders, cryogenic trailers and railcars, cryogenic pumps, cryogenic flow meters, and VIPs.

The BioMedical Segment offers medical respiratory products, such as liquid oxygen and ambulatory oxygen systems that are used primarily for in-home supplemental oxygen treatment of patients with chronic obstructive pulmonary diseases, such as bronchitis, emphysema, and asthma; and vacuum insulated containment vessels for storing biological materials in medical laboratories, biotech/pharmaceutical, research facilities, blood and tissue banks, veterinary laboratories, repositories, and artificial insemination primarily in the beef and dairy industry.

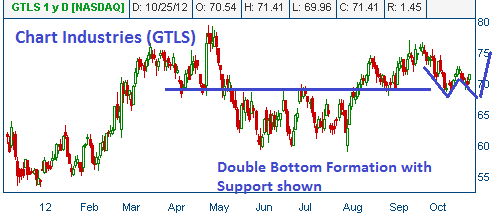

Shares have formed a bullish "double bottom" and have rebounded from the support level of $70. We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares. Note that the firm reports its quarterly results on November 1.

52-Week Trading Range: $52.50 - 79.29

Last Trade: $71.48

Stop Loss: $67.90

Target Price: $78.63