| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Abaxis (ABAX) develops, manufactures, markets, and sells portable blood analysis systems for use in human or veterinary patient-care setting to provide blood constituent measurements for clinicians worldwide.

Abaxis (ABAX) develops, manufactures, markets, and sells portable blood analysis systems for use in human or veterinary patient-care setting to provide blood constituent measurements for clinicians worldwide.

The company offers point-of-care blood chemistry analyzer, which consists of a compact portable analyzer and a series of single-use plastic discs, called reagent discs, containing all the chemicals required to perform a panel of up to 14 tests on human patients and 13 tests on veterinary patients. It markets the blood analysis systems under the Piccolo Xpress, Piccolo Classic, VetScan VS2, and VetScan Classic names.

The company also provides VetScan HM5, VetScan HM2, VetScan HMII, and VetScan HMT hematology instruments, as well as reagent kits for veterinary applications. In addition, it offers VetScan VSpro, which assists in the diagnosis and evaluation of suspected bleeding disorders, toxicity/poisoning, evaluation of disseminated intravascular coagulation, hepatic disease, monitoring therapy, and the progression of disease states.

Further, the company provides Canine Heartworm rapid test to detect dirofilaria immitis in canine whole blood, serum, or plasma; Canine Parvovirus rapid test to detect canine parvovirus antigen in feces; VetScan Giardia rapid test to detect giardiasis, a gastrointestinal infection caused by the protozoan parasite Giardia; and Canine Lyme rapid test to detect Borrelia burgdorferi in canine whole blood, serum, or plasma. Additionally, it offers veterinary reference laboratory diagnostic and consulting services.

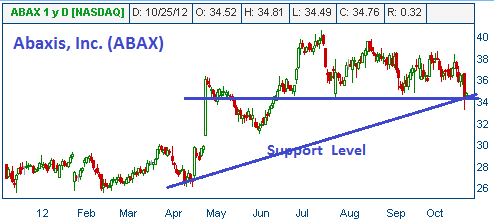

Shares are sitting at a support level and are expected to head higher from present level. We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares. The stock average daily trading volume is 102K. If you decide to take a postion, be sure to use a limit order.

52-Week Trading Range: $24.43 - $40.58

Last Trade: $34.27

Stop Loss: $32.55

Target Price: $37.75

The issue reached our target price of $37.85!