| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Alliance Fiber Optic Products (AFOP) designs, manufactures, and markets various fiber optic components and integrated modules for communications equipment manufacturers and service providers in North America, Europe, and Asia.

Alliance Fiber Optic Products (AFOP) designs, manufactures, and markets various fiber optic components and integrated modules for communications equipment manufacturers and service providers in North America, Europe, and Asia.

It provides connectivity products, including connectivity modules; optical connectors, adapters, and cable assemblies; fused and planar fiber optical splitters and couplers; optical tap couplers and ultra low polarization dependent loss tap couplers; amplifier wave division multiplexers (WDM) couplers; optical fixed attenuators; fused fiber WDM couplers; and fiber array units.

The company also offers optical passive products comprising filter WDMs, amplifier filter WDMs, dense wave division multiplexers (DWDMs), coarse wavelength division multiplexers, compact coarse wavelength division multiplexers, add/drop DWDM filters, optical isolators, optical bypass switches, and automatic variable optical attenuators.

Alliance Fiber Optic Products, Inc. sells its products to communications equipment manufacturers that incorporate the companys products into their systems and sell to network service providers, as well as to other component manufacturers for resale or inclusion in their products.

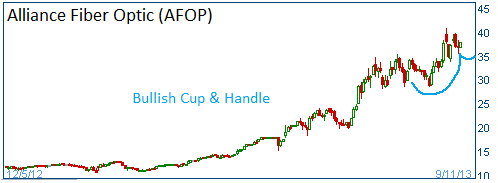

Shares have formed a bullish "cup & handle" adn higher share prices are expected for this stock.

Note: The company will be splitting its shares (2-for-1) on September 16.

52-Week Trading Range: $8.80 - $40.78

Entry Point: $37.78

Stop Loss: $35.89

Target Price: $41.56

AFOP reached our target price. Closed at $41.75. If you elect to stay in the stock, raise your stop loss to $41.00.