| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

ViewPoint Financial Group (VPFG) operates as the holding company for ViewPoint Bank, which provides financial services for consumers and businesses. Its deposit products include checking, savings, money market, demand accounts, and certificates of deposit.

ViewPoint Financial Group (VPFG) operates as the holding company for ViewPoint Bank, which provides financial services for consumers and businesses. Its deposit products include checking, savings, money market, demand accounts, and certificates of deposit.

The companys loan portfolio comprises real estate loans, such as one-to four-family, commercial construction, and home equity loans, as well as commercial real estate loans for office buildings, retail centers, light industrial facilities, warehouses, and multifamily properties; consumer loans, including new and used automobile loans, recreational vehicle loans, loans secured by savings deposits, and unsecured consumer loans; and commercial non-mortgage loans, including loans to finance business working capital, commercial vehicles, and equipment, as well as lines of credit.

It also offers brokerage services for the purchase and sale of non-deposit investment and insurance products through a third party brokerage arrangement. As of March 31, 2011, the company operated 23 community bank offices in the Dallas/Fort Worth Metroplex and 13 loan production offices located in Texas, Oklahoma, and Ohio.

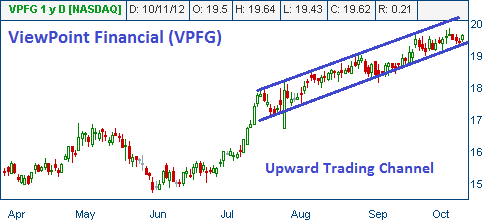

Shares are heading higher in an upward trading channel and presently reside at the lower boundary of the said channel. Higher prices are expected from this level.

52-Week Trading Range: $11.83 - $19.83

Last Trade: $19.42

Stop Loss: $18.45

Target Price: $21.36

We closed our position at $21.60 after stock reached our target price.