| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Lennox International (LII) engages in the design, manufacture, and market of climate control products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

Lennox International (LII) engages in the design, manufacture, and market of climate control products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

The company operates in four segments: Residential Heating & Cooling, Commercial Heating & Cooling, Service Experts, and Refrigeration.

The Residential Heating & Cooling segment manufactures and markets furnaces, air conditioners, heat pumps, packaged heating and cooling systems, indoor air quality equipment, and replacement parts for residential replacement and new construction markets.

The Commercial Heating & Cooling segment offers rooftop units, split system/air handler combinations, small package units, chillers, and fan coils for office and commercial buildings, restaurants, retail centers, churches, schools, shopping malls, other retail and entertainment buildings, and institutional and other field-engineered applications.

The Service Experts segment provides installation, preventive maintenance, emergency repair, and replacement of heating and cooling systems to residential and light commercial customers, as well as sells various manufactured equipment, parts and supplies, and third-party branded products.

The Refrigeration segment offers condensing units, unit coolers, fluid coolers, air cooled condensers, compressor racks, process chillers, and air handlers, as well as display cases and systems; and sells products for non-food and various industry applications.

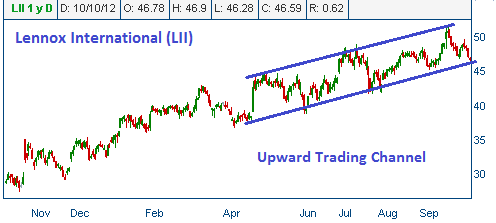

Shares are heading higher in an upward trading channel. Presently, they are setting at the lower boundary of the said channel. Note that the lower boundary of the channel coincides with the stock's 50-day moving average.

We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

52-Week Trading Range: $27.39 - $51.30

Last Trade: $46.60

Stop Loss: $44.25

Target Price: $51.35

We closed the position at $32