| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Bitauto Holdings Limited (BITA) provides Internet content and marketing services for the automotive industry primarily in the Peoples Republic of China.

Bitauto Holdings Limited (BITA) provides Internet content and marketing services for the automotive industry primarily in the Peoples Republic of China.

The company operates in four segments: bitauto.com Advertising Business, EP Platform Business, taoche.com Business, and Digital Marketing Solutions Business.

The bitauto.com Advertising Business segment provides advertising services to dealers and automakers on its bitauto.com Website. The EP Platform Business segment provides Web-based integrated digital marketing and CRM applications to automobile dealers in China. This segments platform enables dealer subscribers to create their own online showrooms, list pricing and promotional information, provide dealer contact information, place advertisements, and manage customer relationships. It also offers third-party marketing applications that enable subscribers to launch their advertisement on third-party Websites. The taoche.com Business segment provides used automobile listing services under the Transtar brand name to automobile dealers and advertising services to automakers and automobile dealers. Its taoche.com Website allows consumers to navigate and select used automobile inventory from its database. The Digital Marketing Solutions Business segment provides one-stop digital advertising solutions, including online advertising, Website creation and maintenance, online public relations, and online marketing campaigns.

The company also distributes its dealer customers' automobile pricing and promotional information through its partner Websites, including portals operated by Tencent and Netease, as well as social networking Websites, Renren and Kaixin.

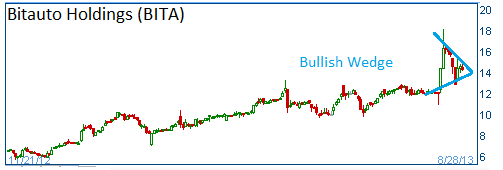

The firm reported quarterly results last week that beat the estimates and guided higher going forward. Sine then, shares have formed a bullish "wedge." Higher share prices are expected for this stock.

52-Week Trading Range: $4.21 - $18.10

Entry Point: $14.29

Stop Loss: $13.57

Target Price: $15.72

We are closing BITA at $15.90 after it exceeded our target price.