| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Arris Enterprises (ARRS) develops, manufactures, and supplies telephony, data, video, construction, rebuild, and maintenance equipment primarily for cable system operators in the broadband communications industry worldwide.

Arris Enterprises (ARRS) develops, manufactures, and supplies telephony, data, video, construction, rebuild, and maintenance equipment primarily for cable system operators in the broadband communications industry worldwide.

The company operates in three segments: Broadband Communications Systems (BCS); Access, Transport, and Supplies (ATS); and Media and Communications Systems (MCS).

The BCS segment provides VoIP and high speed data products. The ATS segment offers hybrid fiber-coaxial plant equipment products. The MCS segment provides media, delivery, and monetization platform products, such as video on demand management and distribution, and linear and advanced advertising; and operations management systems, including network and service assurance, and mobile workforce management products.

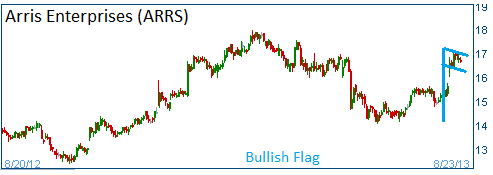

Shares have formed a bullish "flag" following the company's better than expected quarterly report. Higher prices are expected for this stock.

We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

52-Week Trading Range: $12.40 - $17.98

Last Trade: $16.68

Stop Loss: $15.80

Target Price: 18.35

ARRS fell below our stop loss. Position was closed at $15.80.