| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Starbucks Corporation (SBUX) operates as a roaster, marketer, and retailer of specialty coffee worldwide.

Starbucks Corporation (SBUX) operates as a roaster, marketer, and retailer of specialty coffee worldwide.

As of September 30, 2012, the company operated 9,405 company-operated stores and 8,661 licensed stores. Its stores offer regular and decaffeinated coffee beverages, Italian-style espresso beverages, cold blended beverages, iced shaken refreshment beverages, premium Tazo teas, packaged roasted whole bean and ground coffees, Starbucks VIA Ready Brew soluble coffees, Starbucks coffee and Tazo tea K-Cup portion packs, Starbucks Refreshers beverages, juices, and bottled water.

The companys stores also provide various food items, including pastries, prepared breakfast and lunch sandwiches, oatmeal, and salads. In addition, it licenses the rights to produce and distribute Starbucks branded products to The North American Coffee Partnership with the Pepsi-Cola Company, as well as licenses its trademarks through licensed stores, grocery, and national foodservice accounts.

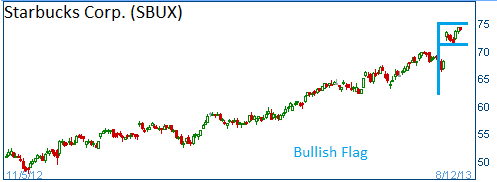

Shares have formed a bullish "flag" and higher share prices are expected for this stock.

52-Week Trading Range: $43.69 - $74.27

Last Trade: $73.90

Here is the Trade:

Buy One September $72.5 Call Option for less than $2.60

Sell One September $77.5 Call Option for $0.70

Payoff table is shown.

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are closing SBUX trade with good results.