| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Ingram Micro (IM) distributes information technology (IT) products; and provides supply chain solutions, mobile device lifecycle services, and logistics solutions worldwide.

Ingram Micro (IM) distributes information technology (IT) products; and provides supply chain solutions, mobile device lifecycle services, and logistics solutions worldwide.

The company’s IT peripherals include printers, scanners, displays, projectors, monitors, panels, mass storage, and tape; large format LCD and plasma displays, enclosures, mounts, media players, content software, and content creation and hosting; mobile phones, digital cameras and video disc players, game consoles, televisions, audio, media management, and home control products; barcode/card printers, AIDC scanners and software, and wireless infrastructure products; IP video surveillance, security and fire alarm systems, and access control smart cards; processors, motherboards, hard drives, and memory products; and ink and toner supplies, paper, carrying cases, and anti-glare screens.

It also provides various systems, including rack, tower, and blade servers; desktops; portable personal computers and tablets; and software products, such as business application, operating system, entertainment, security, storage, and virtualization software products, as well as middleware and developer software tools. The company’s networking products comprise switches, hubs, routers, wireless local area networks, wireless wide area networks, network interface cards, cellular data cards, network-attached storage, and storage area networks; voice over Internet protocol, communications, modems, phone systems, and video/audio conferencing; and firewalls, virtual private networks, intrusion detection, and authentication devices and appliances.

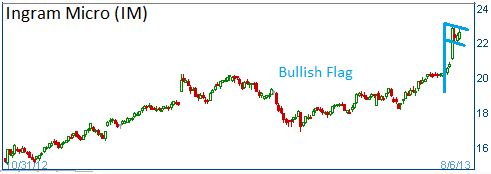

Shares have formed a bullish "flag" and higher share prices are expected for this stock.

52-Week Trading Range: $14.42 - $22.98

Entry Point: $22.90

Here is the trade:

Buy one September $22.50 Call option for less than $0.80

Payoff shown in the table.

Trade

Profit/Loss Analysis

Closing Summary

|

|

IM $22.5 call option closed at $1.09