Put Options on SCHW on 9/17/2012

The Charles Schwab Corporation (CSC) is a savings and loan holding company. The Company engages, through its subsidiaries, in  securities brokerage, banking, and related financial services. The Company provides financial services to individuals and institutional clients through two segments: Investor Services and Institutional Services. The Investor Services segment provides retail brokerage and banking services to individual investors. The Institutional Services segment provides custodial, trading and support services to independent investment advisors (IAs). Its business subsidiaries include Charles Schwab & Co., Inc. (Schwab), Charles Schwab Bank and Charles Schwab Investment Management, Inc. (CSIM), which is the investment advisor for Schwab’s mutual funds. On September 1, 2011, the Company acquired optionsXpress Holdings, Inc. In November 2011, the Company acquired Compliance11, Inc. In September 2012, GAIN Capital Holdings Inc. acquired Open E Cry, LLC.

securities brokerage, banking, and related financial services. The Company provides financial services to individuals and institutional clients through two segments: Investor Services and Institutional Services. The Investor Services segment provides retail brokerage and banking services to individual investors. The Institutional Services segment provides custodial, trading and support services to independent investment advisors (IAs). Its business subsidiaries include Charles Schwab & Co., Inc. (Schwab), Charles Schwab Bank and Charles Schwab Investment Management, Inc. (CSIM), which is the investment advisor for Schwab’s mutual funds. On September 1, 2011, the Company acquired optionsXpress Holdings, Inc. In November 2011, the Company acquired Compliance11, Inc. In September 2012, GAIN Capital Holdings Inc. acquired Open E Cry, LLC.

Stockwinners is Bearish on this name for the following reasons:

- The company reported 285,200 Daily Average Revenue Trades (DARTs) in the second quarter of 2012, a decline of 10% from the first quarter. DARTs were flat between June and July as a negative trend was observed throughout the industry. Although Schwab is yet to reveal metrics for August, Ameritrade’s numbers might provide an indication of the client activity for the month. Ameritrade reported 303,000 client trades per day in August, down 9% from the previous month, a year-on-year decline of 37%. The trend seems to be common within this industry. With the state of the U.S. economy and growing concerns over the national debt, we expect DARTs to remain low for the next few months. The result of the general elections in November might lead to some optimism and have a positive impact on investor confidence. We expect trade volumes to recover in the long-term as the global economy comes out of its shell but in the short-run, the stock is going to struggle .

- The market is already over extended and has lifted bad stocks with no news. The first minor correction will cause such stocks to sell off and SCHW is one of them

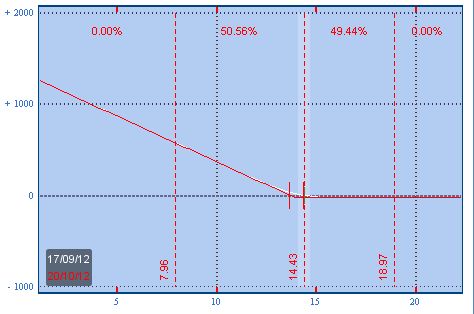

Trade: Buy 1 OCT 14 PUT for less than $.30

Breakeven & Profit/Loss analysis:

- Breakeven at 13.70 by Oct expiration

- Profit up to $13.70 if stock is between $13.70 and $0, max profit $13.70 if stock is $0

- Lose up to $.30 between $14.30 and $14, max loss .30 above $14

The payoff table is presented below:

Trade

- Buy 1 October $14.00 Put at $0.30

- For a net debit of $0.30

Profit/Loss Analysis

- Breakeven at $13.70

- Maximum profit is unbounded

- Maximum loss is ($30.00) at strike of $14.00

Closing Summary

- Sold 1 October $14.00 Put at $0.70

|

|

Position closed on 9/19/2012 at price of $0.70 with a 133.33% gain in 2 days.

Updates

9/19/2012 10:50:05 AM

Stockwinners is happy with the gains from this trade and has decided to close out this position. Please adjust your stop-loss if you decide to stay long in this name.