Call Spread on BAC on 9/10/2012

Bank of America Corporation (Bank of America) is a bank holding company, and a financial holding company. Bank of America is a  financial institution, serving individual consumers, small and middle market businesses, corporations and Governments with a range of banking, investing, asset management and other financial and risk management products and services. Through its banking and various nonbanking subsidiaries throughout the United States and in international markets, the Company provides a range of banking and nonbanking financial services and products through six business segments: Deposits, Card Services, Consumer Real Estate Services (CRES), Global Commercial Banking, Global Banking & Markets (GBAM) and Global Wealth & Investment Management (GWIM), with the remaining operations recorded in All Other. On June 1, 2011, the Company sold Balboa Insurance Company. Effective May 17, 2012, Bank Of America ceased to be holders of Elders Limited.

financial institution, serving individual consumers, small and middle market businesses, corporations and Governments with a range of banking, investing, asset management and other financial and risk management products and services. Through its banking and various nonbanking subsidiaries throughout the United States and in international markets, the Company provides a range of banking and nonbanking financial services and products through six business segments: Deposits, Card Services, Consumer Real Estate Services (CRES), Global Commercial Banking, Global Banking & Markets (GBAM) and Global Wealth & Investment Management (GWIM), with the remaining operations recorded in All Other. On June 1, 2011, the Company sold Balboa Insurance Company. Effective May 17, 2012, Bank Of America ceased to be holders of Elders Limited.

Stockwinners is bullish on this name for the following reasons:

- Financial sector will be the primary beneficiary of any QE program. So in case, we do get any actions from the fed after FOMC meeting this week, BAC is going to pop.

- It is obvious that homebuilders and housing stock have been doing great within the past few months. As housing gets better, more people need to obtain mortgages and loans to finance construction or purchase of a house. Banks are the primary source of capital and are going to benefit from improvement in housing. BAC is going to announce its earnings on OCT 16 and this is a cheaper way to participate in any upside moves.

- Risk/reward ratio is very attractive on this trade.

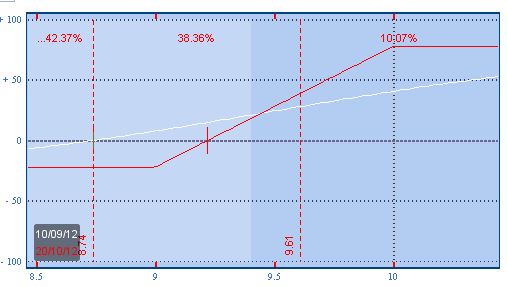

Trade: Buy 1 OCT $9/10 Call spread for $.21

- Buy 1 OCT $9 Call for .29

- Sell 1 OCT $10 Call for .08

Breakeven & Profit/Loss analysis

- Breakeven at $9.21 by October expiration

- Profit up to $.79 between $9.21 to $10.00, max profit .70 above $10

- Lose up to $.21 between $9.21 to $9, max loss .21 below $9

The payoff table is presented below:

Trade

- Buy 1 October $9.00 Call at $0.29

- Sell 1 October $10.00 Call at $0.08

- For a net debit of $0.21

Profit/Loss Analysis

- Breakeven at $9.21

- Maximum profit is $79.00 at strike of $10.00

- Maximum loss is ($21.00) at strike of $9.00

Closing Summary

- Sold 1 October $9.00 Call at $0.45

- Bought 1 October $10.00 Call at $0.11

|

|

Position closed on 9/11/2012 at price of $0.34 with a 61.90% gain in 1 days.

Updates

9/11/2012 4:05:35 PM

Stockwinners is taking profits at this point and is closing out this position. If you decide to stay long, please adjust your stop-loss and lock in your profits.