| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Verizon Communications (VZ) provides communications, information and entertainment products and services to consumers, businesses, and governmental agencies worldwide.

Verizon Communications (VZ) provides communications, information and entertainment products and services to consumers, businesses, and governmental agencies worldwide.

Its Verizon Wireless segment offers access to various wireless voice and data services comprising Internet access through smart phones and basic phones, and notebook computers and tablets; messaging services, which enable customers to send and receive text, picture, and video messages; and consumer-focused and business-focused multimedia applications.

This segment also provides location-based services; global data services; HomeFusion Broadband, a high-speed Internet service for homes; other connection-related services, such as data access and value added services to support telemetry-type applications; and machine-to-machine services that support devices used in healthcare, manufacturing, utilities, distribution, and consumer products markets, as well as sells smart phones and basic phones, tablets, and other Internet access devices.

The companys Wireline segment offers video services over its fiber-optic network; data Services comprising high-speed Internet and FiOS broadband data products, as well as local exchange capacity, managed, mobility, and security services; voice services, such as local exchange, regional, long distance, wire maintenance, and voice messaging services, as well as VoIP, and landline and wireless services; and local dial tone and broadband services to local, long distance, and other carriers.

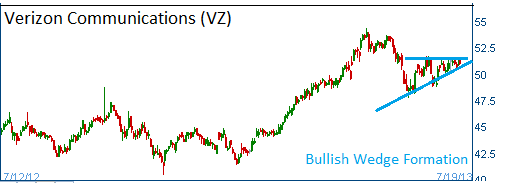

Shares have formed a bullish "wedge" formation ahead of its earnings on July 18. Higher share prices are expected for this stock.

52-Week Trading Range: $40.51 - $54.31

Last Trade: $50.64

Here is the trade: Buy One August $50 Call option for less than $1.50.

The pay off is shown below.

Trade

Profit/Loss Analysis

Closing Summary

|

|