| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

QUALCOMM (QCOM) designs, develops, manufactures, and markets digital telecommunications products and services.

QUALCOMM (QCOM) designs, develops, manufactures, and markets digital telecommunications products and services.

It operates in four segments: QCT, QTL, QWI, and QSI.

The QCT segment develops and supplies integrated circuits and system software based on code division multiple access (CDMA), orthogonal frequency division multiple access (OFDMA), and other technologies for use in voice and data communications, networking, application processing, multimedia, and global positioning systems. The QTL segment grants licenses to use portions of its intellectual property portfolio, which includes patent rights useful in the manufacture and sale of various wireless products, such as products implementing CDMA2000, WCDMA, CDMA TDD, GSM/GPRS/EDGE, and OFDMA standards, as well as their derivatives. The QWI segment provides fleet management, satellite- and terrestrial-based two-way wireless information and position reporting, and other services; software and hardware to transportation and logistics companies; content enablement services for the wireless industry; push-to-talk and other software products and services for wireless network operators; and development, and other services and related products of wireless communications technologies to government agencies and their contractors, as well as builds and manages software applications that enable certain mobile commerce services.

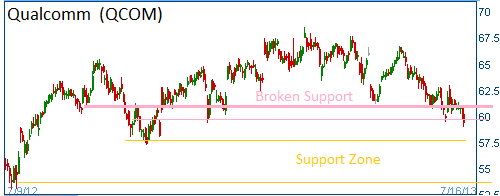

Shares have fallen through a series of support levels (shown in pink). The next support zone is in the $55-$57 range.

52-Week Trading Range: $53.09 - $68.50

Last Trade: $59.41

Here is the trade:

Buy one August $60 Put options for $2.25

Sell one August $55 Put option for $0.60

Net Investment: $1.65

Payoff is shown below.

Trade

Profit/Loss Analysis

Closing Summary

|

|