| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Allergan (AGN) operates as a multi-specialty healthcare company primarily in the United States, Europe, Latin America, and the Asia Pacific.

Allergan (AGN) operates as a multi-specialty healthcare company primarily in the United States, Europe, Latin America, and the Asia Pacific.

The company discovers, develops, and commercializes pharmaceutical, biological, medical device, and over-the-counter products for the ophthalmic, neurological, medical aesthetics, medical dermatological, breast aesthetics, urological, and other specialty markets. It operates in two segments, Specialty Pharmaceuticals and Medical Devices.

The Specialty Pharmaceuticals segment produces a range of pharmaceutical products, including ophthalmic products for dry eye, glaucoma, inflammation, infection, allergy, and retinal disease; Botox for certain therapeutic and aesthetic indications; skin care products for acne, psoriasis, eyelash growth, and other prescription and over-the-counter skin care products; and urologics products. The Medical Devices segment offers a range of medical devices, such as breast implants for augmentation, revision, and reconstructive surgery, as well as tissue expanders; and facial aesthetics products.

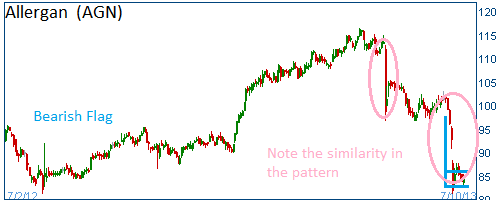

Shares fell earlier after the firm announced that it has stopped development of its treatment for Dry Eyes after it did not achieve the expected end point. Since then shares have formed a bearish flag.

52-Week Trading Range: $81.28 - $116.45

Entry Point: $84.31

Here is the trade:

Buy One AGN August $85 Put Option for less than $3.45

Sell One AGN August $80 Put Option for $1.55

Net Investment: $1.90

Trade

Profit/Loss Analysis

Closing Summary

|

|