| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Krispy Kreme Doughnuts (KKD) operates as a branded retailer and wholesaler of doughnuts, beverages, and treats and packaged sweets worldwide.

Krispy Kreme Doughnuts (KKD) operates as a branded retailer and wholesaler of doughnuts, beverages, and treats and packaged sweets worldwide.

It owns and franchises Krispy Kreme stores. As of February 3, 2013, the company operated 97 company shops, 142 domestic franchise stores, and 509 international franchise shops. It also produces doughnut mixes and doughnut-making equipment. We featured this stock in February with great results.

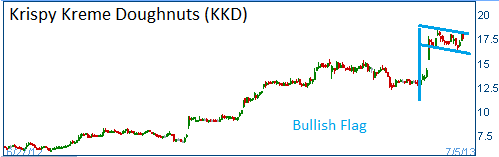

Shares have formed a bullish "flag" and higher share prices are expected for this stock.

We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

52-Week Trading Range: $5.96 - $18.69

Entry Point: $17.50

Here is the trade:

Buy One August $17 Call Option for less that $1.25

Lose $1.25 if stock closes at or below $17 by August Expiration

Breakeven if stock closes at $18.25 by August expiration

Make $1.75 if stock closes at $20 by August expiration

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are closing the KKD call options with a good result.