| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

BHP Billiton Limited (BHP) operates as a diversified natural resources company worldwide.

BHP Billiton Limited (BHP) operates as a diversified natural resources company worldwide.

The company engages in the exploration, development, and production of oil and gas; mining and refining of bauxite into alumina, and smelting of alumina into aluminum metal; and mining of copper, silver, lead, zinc, molybdenum, uranium, and gold, as well as development of potash deposits.

It is also involved in the mining and production of nickel products, manganese ore, and manganese metal and alloys, as well as in the mining of iron ore, metallurgical coal, and thermal coal. BHP Billiton Limited sells its copper, lead, and zinc concentrates, and alumina to smelters; copper cathode to wire rod mills, brass mills, and casting plants; uranium oxide to electricity generating utilities; rough diamonds to diamond buyers; nickel products to stainless steel, specialty alloy, foundry, chemicals, and refractory material industries; metallurgical coal to steel producers; and energy coal to power stations, power generators, and industrial users.

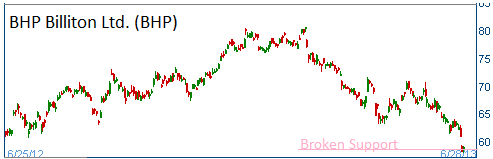

Shares have fallen through all supports and are trading at a new yearly low. Furthermore, the rise in the U.S. dollar means lower commodity prices, as they are denominated in the greenback. Lower prices for this stock are expected.

52-Week Trading Range: $58.02 - $80.54

Last Trade: $58.00

Here is the trade:

Buy One August $60 Put for less than $3.40

Sell One August $55 Put for $1.50

Net Investment: $1.90

The payoff is shown in the chart below.

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are using today's weakness in BHP to lock in profits