Call Spread on LVS on 8/27/2012

Las Vegas Sands (LVS) brings a touch of Venice to the US and China. Replete with gondoliers and a replica of the Rialto Bridge, the company's Venetian Las Vegas Hotel, Resort & Casino offers a 120,000-sq.-ft. casino and a 4,000-suite hotel, as well as a shopping, dining, and entertainment complex. Through its majority-owned Sands China subsidiary, the firm operates The Venetian Macau on the Cotai Strip (the Chinese equivalent of the Las Vegas Strip), as well as two other properties in Macao. Properties also include the Marina Bay Sands in Singapore and the partially-owned Sands Bethlehem in Bethlehem, Pennsylvania. Billionaire casino mogul Sheldon Adelson and trusts for his family own about 55% of Las Vegas Sands.

company's Venetian Las Vegas Hotel, Resort & Casino offers a 120,000-sq.-ft. casino and a 4,000-suite hotel, as well as a shopping, dining, and entertainment complex. Through its majority-owned Sands China subsidiary, the firm operates The Venetian Macau on the Cotai Strip (the Chinese equivalent of the Las Vegas Strip), as well as two other properties in Macao. Properties also include the Marina Bay Sands in Singapore and the partially-owned Sands Bethlehem in Bethlehem, Pennsylvania. Billionaire casino mogul Sheldon Adelson and trusts for his family own about 55% of Las Vegas Sands.

Stockwinners.com is bullish on this name for the following reasons:

- Double digits revenue growth in Macau

- Margins are improving in Macau

- LVS shares are trading at historical low valuation at 18X earning and is relatively cheap compared to other names in this sector.

- The trade structure has a great payoff of 1:3 (aiming for sale before expiration)

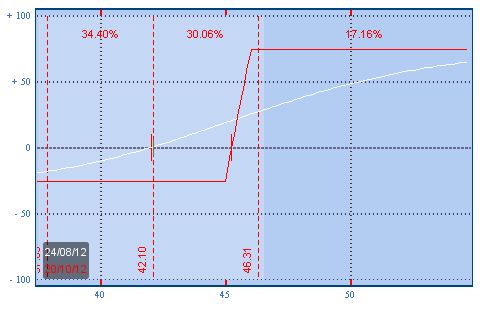

Trade: Buy 1 Oct $45/$46 call spread for less than $0.25

- Buy 1 OCT $45 Call for $1.13

- Sell 1 OCT $46 Call for $0.87

Breakeven & profit/loss Analysis

- Breakeven at $45.25 by Oct expiration

- Profit up to $.75 between $45.25 to $46, Max profit of $.75 above $46 by Oct expiration

- Loss up to $.25 between $45.25 to $45, max loss $.25 below $45 by Oct expiration

The payoff table is presented below:

Trade

- Buy 1 October $45.00 Call at $1.13

- Sell 1 October $46.00 Call at $0.88

- For a net debit of $0.25

Profit/Loss Analysis

- Breakeven at $45.25

- Maximum profit is $75.00 at strike of $46.00

- Maximum loss is ($25.00) at strike of $45.00

Closing Summary

- Sold 1 October $45.00 Call at $3.15

- Bought 1 October $46.00 Call at $2.38

|

|

Position closed on 9/25/2012 at price of $0.77 with a 208.00% gain in 28 days.