| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Alibaba Group Holding Limited (BABA) operates as an online and mobile commerce company in the Peoples Republic of China and internationally.

It operates Taobao Marketplace, an online shopping destination; Tmall, a third-party platform for brands and retailers; Juhuasuan, a group buying marketplace; Alibaba.com, an online business-to-business marketplace that focuses on global trade among businesses; 1688.com, an online wholesale marketplace; and AliExpress, a consumer marketplace.

The company also provides pay-for-performance and display marketing services through its Alimama marketing technology platform; Taobao Ad Network and Exchange (TANX), a real-time online advertising exchange in China; and data management platform that allows participants on TANX to evaluate and select online advertising inventory using behavioral data, as well as data from browsing behavior and shopping history.

In addition, it offers cloud computing services, including elastic computing, database services, and storage and large scale computing services through its Alibaba Cloud Computing platform; Web hosting and domain name registration services; payment and escrow services for buyers and sellers; and develops and operates mobile Web browsers. The company provides its solutions primarily for businesses.

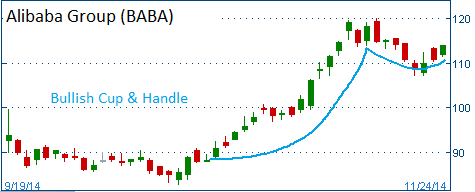

Shares of this recent IPO have formed a bullish "cup & handle" ahead of its first quarterly report as a public company. The firm reports its earnings on November 4th. We expect a strong report from the firm that should push shares higher out of their bullish formation.

52-Week Trading Range: $82.81 - $120.00

Entry Point: $114.00

Trade

Profit/Loss Analysis

Closing Summary

|

|