| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

NVIDIA Corporation (NVDA) operates as a visual computing company.

NVIDIA Corporation (NVDA) operates as a visual computing company.

The company operates through two segments, GPU and Tegra Processors.

The GPU segment offers GeForce for consumer desktop and notebook personal computers; Quadro for professional workstations; Tesla for high-performance servers and workstations; and NVIDIA GRID for server graphics solutions.

The Tegra Processors segment offers Tegra processors for smartphones, tablets, gaming devices, and other computer devices, such as Windows RT-based devices, set-top boxes, chromebooks, clamshells, and others; Icera baseband processors and radio frequency transceivers for mobile connectivity; Tegra NOTE, a tablet platform based on Tegra 4; Tegra VCM, a Tegra-based vehicle computing module that integrates an automotive computer into a single component; and SHIELD, an android gaming device for digital content in the cloud.

The companys products are used in gaming, design and visualization, high performance computing, data center, and automotive and smart device markets. NVIDIA Corporation sells its products to equipment manufacturers, original design manufacturers, system builders, motherboard manufacturers, and add-in board manufacturers in the United States, China, Taiwan, the rest of Asia Pacific, Europe, and other Americas.

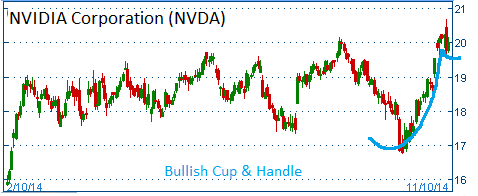

Shares have formed a bullish "cup and handle" and higher share prices are expected for this stock.

52-Week Trading Range: $14.90 - $20.69

Last Trade: $20.02

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on NVDA Call options. Closed at $2.18.