| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Caterpillar Inc. (CAT) manufactures and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives worldwide.

Caterpillar Inc. (CAT) manufactures and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives worldwide.

The companys Construction Industries segment offers construction machines and related parts, including backhoe, small wheel, skid steer, multi-terrain, medium wheel, compact track, compact wheel, and track-type loaders; mini excavators and wheel excavators, as well as small, medium, and large track excavators; small track-type and medium track-type tractors; and select work tools, motor graders, and pipelayers for the heavy construction, general construction, mining and quarry, and aggregates markets.

Its Resource Industries segment provides electric rope and hydraulic shovels; draglines; drills; highwall and longwall miners; hard rock vehicles; large track-type tractors; articulated, large mining, and off-highway trucks; large wheel loaders; wheel tractor scrapers; wheel dozers; machinery components; and electronics and control systems for mine, quarry, forestry, paving, tunneling, waste, and industrial customers.

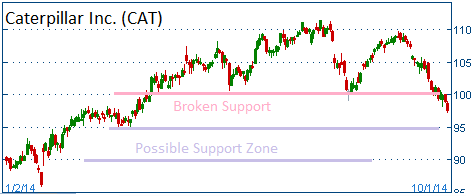

Shares of this Dow Component, have fallen through a key support level. Slowing Chinese economy has hurt CAT as China is a major market for Caterpillar. The $90 level appears to be a solid support for the stock.

52-Week Trading Range: $81.87 - $111.46

Last Trade: $97.61.

Here is the trade:

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on CAT put spread.