Call Spread on WLT on 8/21/2012

Walter Energy has renewed energy for exploiting natural resources. Its subsidiaries include Jim Walter Resources (coal production)  and Walter Coke (formerly Sloss Industries -- foundry and furnace coke). Its primary business is the mining and exporting of hard coking coal for the steel industry through its Underground Mining coal segment which accounts for more than 80% of Walter Energy's total sales. The company also develops methane gas that is found in its coal seams. Formerly a diversified company that included water products, homebuilding, and financing units, Walter Energy has divested itself of all but its natural resources and energy businesses.

and Walter Coke (formerly Sloss Industries -- foundry and furnace coke). Its primary business is the mining and exporting of hard coking coal for the steel industry through its Underground Mining coal segment which accounts for more than 80% of Walter Energy's total sales. The company also develops methane gas that is found in its coal seams. Formerly a diversified company that included water products, homebuilding, and financing units, Walter Energy has divested itself of all but its natural resources and energy businesses.

Stockwinners is bullish on this name for the following reasons:

- Energy sector has been lagging the recent rally and is likely to catch up

- Shares have formed a triangle formation and are going to break out of this formation

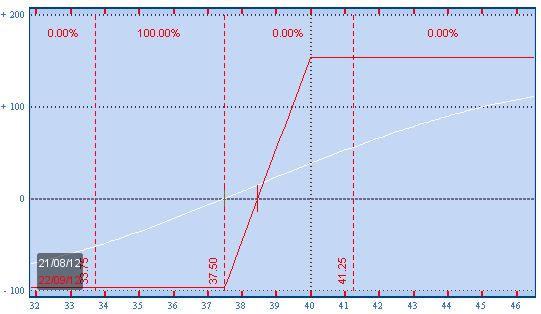

Trade: Buy 1 SEPT $37.5 /$40 Call spread for less than $1.00

- Buy 1 SEPT call $37.50 for $2.80

- Sell 1 SEPT call $40 for $1.80

Breakeven & profit/loss analysis

- Breakeven at $38.50

- Profit up to $1.50 between $38.50 to $40 , max profit of $1.50 above $40 on SEPT expiration

- Losses up to $1.00 between$38.50 to $37.50, Max loss of $1.50 below $37.50 on SEPT expiration

The payoff table is presented below:

Trade

- Buy 1 September $37.50 Call at $2.80

- Sell 1 September $40.00 Call at $1.80

- For a net debit of $1.00

Profit/Loss Analysis

- Maximum profit is $150.00 at strike of $40.00

- Maximum loss is ($100.00) at strike of $37.00

Closing Summary

- Sold 1 September $37.50 Call at $0.00

- Bought 1 September $40.00 Call at $0.00

|

|

Position closed on 9/22/2012 at price of $0.00 with a -100.00% loss in 32 days.

Updates

9/21/2012 8:00:00 PM

This position expired on Friday 21st of September 2012.