| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Yelp Inc. (YELP) operates as an online local guide that connects people primarily with boutiques, mechanics, restaurants, and dentists.

Yelp Inc. (YELP) operates as an online local guide that connects people primarily with boutiques, mechanics, restaurants, and dentists.

The companys local advertising services include free online business account that enables businesses to view business trends, use the revenue estimator tool, message customers, update information, and offer Yelp deals and gift certificates; enhanced listing solution, which eliminates search advertising from the businesses profile pages and allows to incorporate a video clip or photo slide show on the pages; search and other ads services; and call to action, a feature that allows businesses to promote various transaction.

It also offers brand advertising solutions, such as traditional display advertising comprising graphic and text display advertisements on companys Website and mobile applications; and brand sponsorships for various national brands from automobile, financial services, logistics, consumer goods, and health and fitness industries comprising traditional display advertising.

In addition, the company provides Yelp platform, which allows consumers to transact directly; online reservation services in restaurants and nightlife venues; Yelp deals, a product that allows local business owners to create promotional discounted deals for products and services; and gift certificates products for local business owners to sell full-price gift certificates directly to customers. It serves customers in Australia, Austria, Belgium, Brazil, Canada, the Czech Republic, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, New Zealand, Norway, Poland, Portugal, Singapore, Spain, Sweden, Switzerland, Turkey, the United Kingdom, and the United States.

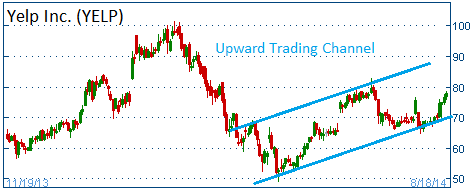

Shares are heading higher in an upward trading channel. Higher share prices are expected for this stock.

52-Week Trading Range: $49.01 - $101.75

Last Trade: $77.85

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on YELP call spread. YELP last traded at $82.20.