| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Tesla Motors, Inc. (TSLA) designs, develops, manufactures, and sells electric vehicles and electric vehicle powertrain components.

Tesla Motors, Inc. (TSLA) designs, develops, manufactures, and sells electric vehicles and electric vehicle powertrain components.

The company also provides services for the development of electric powertrain systems and components, and sells electric vehicle powertrain components to other automotive manufacturers.

It markets and sells its vehicles through Tesla stores and galleries, as well as over the Internet. The company operates a network of 80 stores and galleries in North America, Europe, and Asia.

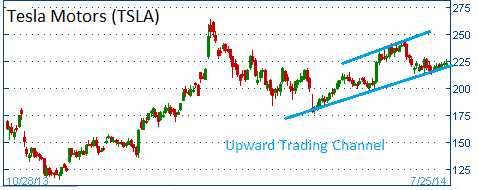

Shares are heading higher in an upward "trading channel." The firm is scheduled to report its results on July 31. Estimates call for a profit of 4 cents per share.

52-Week Trading Range: $1161.10 - $265.00

Last Trade: $223.30

Here is the trade:

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on TSLA call spread of this morning. Closed at $2.85.