| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

SouFun Holdings Limited (SFUN) operates a real estate Internet portal, and a home furnishing and an improvement Website in the Peoples Republic of China.

SouFun Holdings Limited (SFUN) operates a real estate Internet portal, and a home furnishing and an improvement Website in the Peoples Republic of China.

The company offers marketing services on its Websites, primarily through advertisements to real estate developers in the marketing phase of new property developments, as well as to real estate agencies; and suppliers of home furnishing and improvement, and other home-related products and services.

It also provides e-commerce services, including free and paid SouFun membership and online transaction platform services comprising regular updates regarding local property developments, tours to visit property developments, and other services relating to property purchases, as well as paid services primarily consisting of offers to purchase properties at a discount from its partner developers and information and related services to facilitate property purchases. In addition, the company, through its jiatx.com Website, offers an online transaction platform and related e-commerce services to home furnishing and improvement vendors. Further, it provides basic listing services that enable customers to post information of their products and services on Websites, as well as special listing services, which offer customized marketing programs involving online listings and offline themed events to real estate agents, brokers, developers, and property owners and managers; and suppliers of home furnishing and improvement and other home-related products and services.

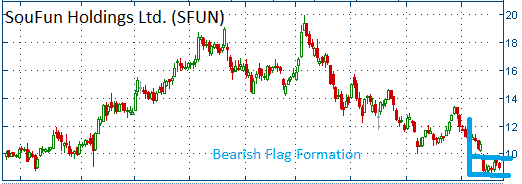

Shares have formed a bearish"flag" as the housing market is China is cooling off. Bloomberg reports that $33billion in Chinese real estate trust bonds will become due in the next few months and it predicts that there will be some major real estate collapses in China. That news means bad news for SFUN. Lower prices are expected for this stock as it has formed a bearish "flag."

52-Week Trading Range: $4.60 - $19.94

Last Trade: $9.01

Trade

Profit/Loss Analysis

Closing Summary

|

|