| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

MasTec (MTZ) is an infrastructure construction company. The firm engages in engineering, building, installing, maintaining, and upgrading energy, communication, and utility infrastructure in North America. The company builds natural gas, crude oil, and refined product transport pipelines; underground and overhead distribution systems, including trenches, conduits, cable, and power lines, which provide wireless and wireline communications; electrical power generation, transmission, and distribution systems; renewable energy infrastructure comprising wind and solar farms; and compressor and pump stations, and treatment and heavy industrial plants. It installs buried and aerial fiber optic cables, coaxial cables, copper lines, electrical, and other energy distribution systems, transmission systems, and satellite dishes in various environments. In addition, the company provides maintenance and upgrade support services, such as maintenance of distribution facilities; networks and infrastructure, including natural gas and petroleum pipeline; and wireless and electrical distribution and transmission infrastructure. Further, it offers emergency services for accidents or storm damage. The company primarily serves utility, communications, and government industries.

MasTec (MTZ) is an infrastructure construction company. The firm engages in engineering, building, installing, maintaining, and upgrading energy, communication, and utility infrastructure in North America. The company builds natural gas, crude oil, and refined product transport pipelines; underground and overhead distribution systems, including trenches, conduits, cable, and power lines, which provide wireless and wireline communications; electrical power generation, transmission, and distribution systems; renewable energy infrastructure comprising wind and solar farms; and compressor and pump stations, and treatment and heavy industrial plants. It installs buried and aerial fiber optic cables, coaxial cables, copper lines, electrical, and other energy distribution systems, transmission systems, and satellite dishes in various environments. In addition, the company provides maintenance and upgrade support services, such as maintenance of distribution facilities; networks and infrastructure, including natural gas and petroleum pipeline; and wireless and electrical distribution and transmission infrastructure. Further, it offers emergency services for accidents or storm damage. The company primarily serves utility, communications, and government industries.

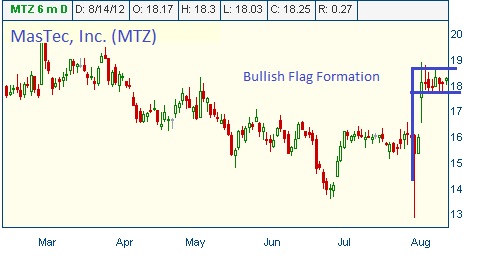

Stockwinners is bullish on this name for the following reasons:

TRADE: BUY 1 September $17.50 Call for less than $1.35

Last trade on the stock: $18.50

Breakeven & profit/loss Analysis:

Trade

Profit/Loss Analysis

Closing Summary

|

|