| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Royal Caribbean Cruises Ltd. (RCL) operates in cruise vacation industry in North America and internationally.

Royal Caribbean Cruises Ltd. (RCL) operates in cruise vacation industry in North America and internationally.

The company owns five cruise brands: Royal Caribbean International, Celebrity Cruises, Pullmantur Cruises, Azamara Club Cruises, and CDF Croisieres de France.

The Royal Caribbean International brand serves the contemporary segments providing a range of onboard services, amenities, and activities. Its offerings principally include swimming pools, sun and lawn decks, spa facilities, beauty salons, bungee jumping trampolines, boxing rings, gaming facilities, lounges, bars, dining venues, hot glass shows, retail shopping, libraries, recreational areas for youth of various ages, cinemas, conference centers, Internet cafes, shore excursions at each port of call, ice skating rinks, and water park.

The Celebrity Cruises brand operates onboard upscale ships that offer spa facilities, dining, venue featuring live grass, glass blowing studio, and personalized services serving the premium segment. The Pullmantur Cruises brand offers onboard activities and services, including exercise facilities, swimming pools, beauty salons, gaming facilities, and shopping, dining, and entertainment venues serving the contemporary segment of the Spanish, Portuguese, and Latin American markets. The Azamara Club Cruises brand to serve the up-market segment of the North American, the United Kingdom, and German markets offering onboard services, amenities, and activities, including gaming facilities, dining, and interactive entertainment venues. The CDF Croisieres de France brand serves the contemporary segment of the French cruise market. The company has a joint venture with TUI AG, which operates TUI Cruises designed to serve the contemporary and premium segments of the German cruise market. As of December 31, 2009, it operated 38 ships in the cruise vacation industry with approximately 84,050 berths. The company was founded in 1968 and is based in Miami, Florida.

The sector is under pressure after Carnival Cruise (CCL) warned of lower earnings. Lower ticket prices, increased cancellations, and higher selling and administrative costs are some of the reasons stated for the sector's under performing.

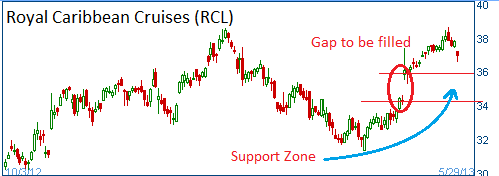

Shares are heading lower and are expected to find support somewhere between $34-$34.50. That is where the initial gap up was. Basically, the gap has to be filled.

Stock last traded at $37.02

Trade

Profit/Loss Analysis

Closing Summary

|

|

Stockwinners is closing this position and is taking its profit off the table. Be sure to adjust your stop-loss if you decide to stay short.

Sell 1 July put spread 37/24 for 1.75