| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Delta Air Lines (DAL) provides scheduled air transportation for passengers and cargo in the United States and internationally.

Delta Air Lines (DAL) provides scheduled air transportation for passengers and cargo in the United States and internationally.

Its route network is centered around a system of hub and international gateway airports in Amsterdam, Atlanta, Cincinnati, Detroit, Memphis, Minneapolis-St. Paul, New York - LaGuardia, New York-JFK, Paris-Charles de Gaulle, Salt Lake City, Seattle and Tokyo-Narita. The company sells its tickets through various distribution channels, including telephone reservations, delta.com, global distribution systems, and online travel agencies. Its also provides aircraft maintenance, repair, and overhaul services for other aviation and airline customers, as well as offers staffing services, professional security and training services, and aviation solutions for third parties; vacation packages; and aircraft charters and aircraft management and programs.

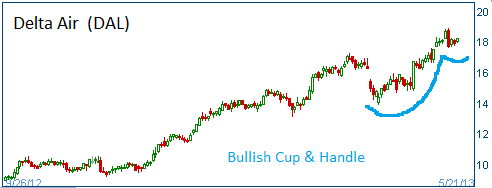

Shares have formed a bullish "cup & handle" and higher prices are expected for this stock.

We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

52-Week Stock Trading Range: $8.42 - $18.88

Last Trade: $18.25

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are closing the DAL position as options expire in three days.