| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Oracle Corporation (ORCL) develops, manufactures, markets, hosts, and supports database and middleware software, applications software, and hardware systems. It licenses database and middleware software, including database and database management, application server and cloud application, service-oriented architecture and business process management, business intelligence, identity and access management, data integration, Web experience management, portals, and content management and social network software, as well as development tools and Java, a software development platform; and applications software comprising enterprise resource planning, customer relationship management, financials, governance, risk and compliance, procurement, supply chain management, enterprise portfolio project and enterprise performance management, business intelligence analytic applications, Web commerce, and industry-specific applications software.

Oracle Corporation (ORCL) develops, manufactures, markets, hosts, and supports database and middleware software, applications software, and hardware systems. It licenses database and middleware software, including database and database management, application server and cloud application, service-oriented architecture and business process management, business intelligence, identity and access management, data integration, Web experience management, portals, and content management and social network software, as well as development tools and Java, a software development platform; and applications software comprising enterprise resource planning, customer relationship management, financials, governance, risk and compliance, procurement, supply chain management, enterprise portfolio project and enterprise performance management, business intelligence analytic applications, Web commerce, and industry-specific applications software.

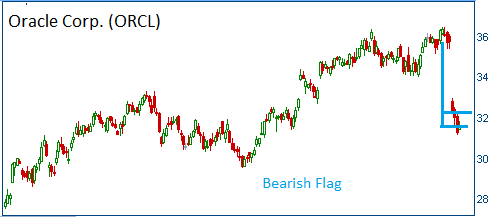

The company also provides customers with rights to unspecified software product upgrades and maintenance releases; Internet access to technical content; and Internet and telephone access to technical support personnel. In addition, it offers computer server, storage and networking product, and hardware-related software, such as Oracle Solaris Operating System; Oracle engineered systems; storage products, which comprise tape, disk, and networking solutions for open systems and mainframe server environments; and hardware systems support solutions, including software updates for the software components, as well as product repair, maintenance, and technical support services. Shares have formed a bearish "flag" follwoing the company's poor quarterly results.

52-Week Trading Range: $25.33 - $36.43

Last Trade: $31.55

Trade

Profit/Loss Analysis

Closing Summary

|

|