| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

AeroVironment (AVAV) engages in the design, development, production, support, and operation of unmanned aircraft systems, and efficient energy systems for various industries and governmental agencies.

AeroVironment (AVAV) engages in the design, development, production, support, and operation of unmanned aircraft systems, and efficient energy systems for various industries and governmental agencies.

It offers small unmanned aircraft systems (UAS), which provide ISR and communications, including real-time tactical reconnaissance, tracking, combat assessment, and geographic data to the small tactical unit or individual war fighter. The small UAS wirelessly transmit critical live video and other information to a hand-held ground control unit, enabling the operator to view and capture images. The company also provides spare equipment, alternative payload modules, batteries, chargers, repair services, and customer support services for small UAS.

AeroVironment, Inc. sells its products to organizations within the Department of Defense, including the U.S. Army, Marine Corps, Special Operations Command, and Air Force, as well as to domestic and international commercial, consumer, and government customers. The company has a strategic relationship with CybAero AB to develop and distribute a Tier II vertical takeoff and landing unmanned aircraft system.

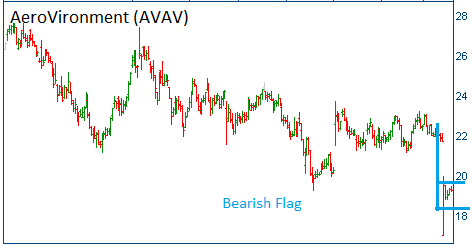

Shares have formed a bearish "flag" following the release of its quarterly results. Lower prices are expected for this stock. Here is a breakdown of its results:

Revenue fell 34.6%, to $47.1 million in the quarter, which was well below the $89.2 million analysts expected. On the bottom line, profit fell from $5.7 million a year ago, to $3.9 million, or $0.17 per share, which was less than half of the $0.37 estimate from Wall Street. There was about $100 million of revenue that slipped from fiscal 2013 to fiscal 2014, according to management. That resulted in this quarter's weakness, and a fiscal forecast that was more than $100 million below its previous estimate.

52-Week Trading Range: $16.98 - $27.82

Last Trade: $19.13

Trade

Profit/Loss Analysis

Closing Summary

|

|

We closed the put at $1.96