| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Tyler Technologies (TYL) provides integrated information management solutions and services for the public sector with a focus on local governments in the United States and internationally.

Tyler Technologies (TYL) provides integrated information management solutions and services for the public sector with a focus on local governments in the United States and internationally.

It operates through Enterprise Software Solutions, and Appraisal and Tax Software Solutions and Services segments. The companys financial management solutions include modular fund accounting systems for government agencies and not-for-profit entities; and utility billing systems to support the billing and collection of metered and non-metered services. It also offers products to automate various city functions, such as municipal courts, parking tickets, equipment and project costing, animal and business licenses, permits and inspections, code enforcement, citizen complaint tracking, ambulance billing, fleet maintenance, and cemetery records management; financial management, student information, and transportation solutions to K-12 schools; and software applications.

In addition, the company provides integrated suite of judicial solutions comprising court case management, court and law enforcement, prosecutor, and supervision systems to handle complex, multi-jurisdictional county, statewide implementations, and single county systems; systems and software to automate the appraisal and assessment of real and personal properties; tax applications for agencies that bill and collect taxes; and software applications that enable county governments to enhance and automate courthouse operations.

Further, it offers subscription-based services, such as software as a service arrangements and electronic document filing solutions for courts and law offices; professional IT services, including software and hardware installation, data conversion, training, and product modifications; and outsourced property appraisal services for taxing jurisdictions, as well as customer support services.

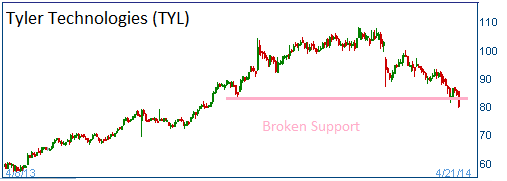

Shares have fallen through a support level shown on the chart. The company has a PE of 70 which makes prime for a sell-off.

52-Week Trading Range: $57.00 - $107.99

Last Trade: $80.00

Here is the trade:

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on TYL put spread option.