| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Hibbett Sports (HIBB) operates sporting goods stores in small to mid-sized markets primarily in the south, Southwest, Mid-Atlantic, and the Midwest regions of the United States.

Hibbett Sports (HIBB) operates sporting goods stores in small to mid-sized markets primarily in the south, Southwest, Mid-Atlantic, and the Midwest regions of the United States.

Its stores offer an assortment of merchandise, including athletic footwear, team sports equipment, athletic and fashion apparel, and related accessories. As of November 2, 2013, it had 904 in 31 states. The company sells its merchandise directly to educational institutions and youth associations.

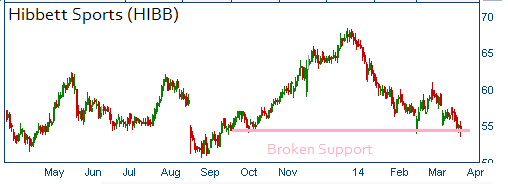

Shares have fallen below a support level and lower prices are expected. The sell-off has come after Q4 came in below estimates. On March 14, Hibbett reported fourth-quarter earnings per share of 64 cents, down 12.3% from the year-ago quarter earnings of 73 cents and short of the Consensus Estimate of 69 cents. Moreover, the company’s fiscal 2015 forecast pointed to higher costs for the year that is expected to impact margins. The company anticipates flat to slightly positive gross margin in the upcoming fiscal year. The softness in shares expected to continue pushing shares toward the $50 level.

52-Week Trading Range: $50.67 - $68.31

Last Trade: $54.26

Here is the trade:

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on HIBB put spread.