| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Garmin Ltd. (GRMN) designs, develops, manufactures, and markets global positioning system (GPS) enabled products and other navigation, communication, and information products for the automotive/mobile, outdoor, fitness, marine, sailing and yachting, and general aviation markets worldwide.

Garmin Ltd. (GRMN) designs, develops, manufactures, and markets global positioning system (GPS) enabled products and other navigation, communication, and information products for the automotive/mobile, outdoor, fitness, marine, sailing and yachting, and general aviation markets worldwide.

The company offers a range of automotive navigation products, and various products and applications designed for the mobile GPS market; GPS enabled handheld products for hunters, hikers, geocachers, outdoors enthusiasts, cyclists, and golfers; dog tracking systems; tracker systems; and training assistants for athletes.

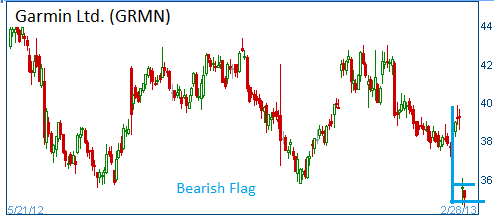

Shares have formed a bearish "flag" following the release of its quarterly results. Lower prices are expected for this stock. Garmin said earnings per share fell 22% to $0.66 from $0.85 a year ago. Revenue declined 16% to $768.5 million as demand for standalone navigation devices continued to wane, since more consumers own smartphones already equipped with equivalent GPS capabilities. Garmin's results were significantly below analysts' projections of $0.74 profit per share and revenue at $833.7 million. EPS guidance was also well below analyst expectations, as management projected 2013 earnings at $2.30 to $2.40 a share versus estimates of $2.89. GRMN last traded at $35.10

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are closing GRMN position with a 33% return as our 30-day time period expired.