| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Diamond Offshore Drilling (DO) provides contract drilling services to the energy industry world wide.

Diamond Offshore Drilling (DO) provides contract drilling services to the energy industry world wide.

The company provides drilling services in ultra-deepwater, deepwater, and mid-water; and non-floater or jack-up markets.

Its fleet consists of 45 offshore drilling rigs comprising 33 semisubmersibles, of which 2 are under construction; 7 jack-ups; and 5 dynamically positioned drillships, of which 3 are under construction.

Its customers include independent oil and gas companies, and government-owned oil companies.

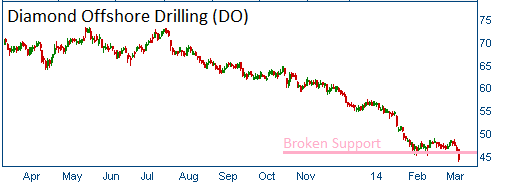

Shares have fallen below a support level of $46.50, and lower share prices are expected for this stock. Energy prices took a hit on Wednesday and Thursday, which certainly isn't improving Diamond Offshore's prospects.

52-Week Trading Range: $43.95 - $73.19

Last Trade: $44.39

Here is the trade:

Trade

Profit/Loss Analysis

Closing Summary

|

|