| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Vulcan Materials Company (VMC) produces and sells construction aggregates, asphalt mix, ready-mixed concrete, and cement primarily in the United States.

Vulcan Materials Company (VMC) produces and sells construction aggregates, asphalt mix, ready-mixed concrete, and cement primarily in the United States.

The companys Aggregates segment offers crushed stone, sand and gravel, sand, and other aggregates, as well as related products and services. This segments aggregates are used in public- and private-sector construction projects, including highways, airports, water and sewer systems, industrial manufacturing facilities, and residential and nonresidential buildings, as well as railroad track ballast. Its Concrete segment produces and sells ready-mixed concrete in California, Florida, Georgia, Maryland, Texas, Virginia, and the District of Columbia, as well as the Bahamas; and other concrete products, such as blocks, as well as resells purchased building materials for use with ready-mixed concrete and concrete blocks.

The companys Asphalt Mix segment offers asphalt mix in Arizona, California, and Texas. Its Cement segment provides Portland and masonry cement in bulk and bags to the concrete products industry. This segment also imports and exports cement, clinker, and slag, as well as resells, grinds, blends, bags, or reprocess them. In addition, the Cement segment mines, produces, and sells calcium products for the animal feed, paint, plastics, water treatment, and joint compound industries.

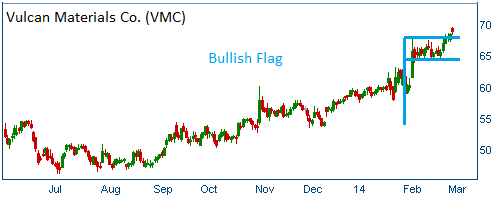

Shares have formed a bullish "flag" following the company's extention of its share repurchase program. The firm also raised its dividend by 400% to 5c per share.

52-Week Trading Range: $45.42 - $69.44

Last Trade: $68.82

Here is the trade:

Trade

Profit/Loss Analysis

Closing Summary

|

|