| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Buffalo Wild Wings (BWLD) engages in the ownership, operation, and franchise of restaurants primarily in the United States. It offers chicken and various food and beverage items, as well as serves bottled beers, wines, and liquor. The company operates its restaurants under Buffalo Wild Wings Grill & Bar brand name.

Buffalo Wild Wings (BWLD) engages in the ownership, operation, and franchise of restaurants primarily in the United States. It offers chicken and various food and beverage items, as well as serves bottled beers, wines, and liquor. The company operates its restaurants under Buffalo Wild Wings Grill & Bar brand name.

Stockwinners.com is bearish on this stock for the following reason:

Chicken prices are on the rise (see report from Tyson Food (TSN)) due to the last summer's drought and higher feed prices. TSN is one the largest chicken producers.

Chart has formed a multi-week bearish flag follwoing the company's last quarterly report.

There is a chicken wing shortage and that should directly affect this company

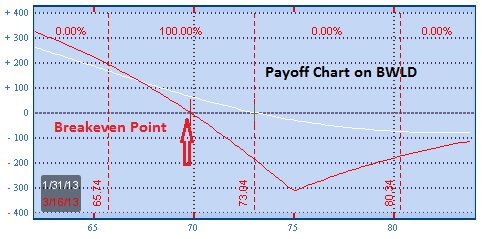

Here is the trade:

Buy One March $75 Put at $4.70

Sell One June $70 Put at $4.90

Receive 20c in credit

See the pay off chart below

Lose $1 if stock goes to $80+ by expiration in March

Make $2.00 if stock closes at $66 by Expiration

Make $3.00 if stock closes at $55 by Expiration

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are closing the BWLD trade. The stock was upgraded today and got a pop, and unfortunately we are on the wrong side of the trade. We are closing the position at .40 debit (0.2 credit at time of purchase and 0.60 debit at time of closing netting .4 debit) :(