Put Butterfly on AMZN on 1/29/2013

Amazon.com, Inc. (Amazon.com) serves consumers through its retail Websites and focuses on selection, price, and convenience. The Company's four customer sets include consumers, sellers, enterprises and content creators. It also manufactures and sells Kindle devices. It offers programs, which enable sellers to sell their products on its Websites and their own branded Websites and to fulfill orders through it. We serve developers and enterprises of all sizes through Amazon Web Services (AWS), which provides access to technology infrastructure. In addition, it generates revenue through other marketing and promotional services, such as online advertising, and co-branded credit card agreements. In June 2012, the Company acquired the publication rights from Avalon Books to over 3,000 backlist titles predominantly in the Romance, Mystery and Western categories.

Company's four customer sets include consumers, sellers, enterprises and content creators. It also manufactures and sells Kindle devices. It offers programs, which enable sellers to sell their products on its Websites and their own branded Websites and to fulfill orders through it. We serve developers and enterprises of all sizes through Amazon Web Services (AWS), which provides access to technology infrastructure. In addition, it generates revenue through other marketing and promotional services, such as online advertising, and co-branded credit card agreements. In June 2012, the Company acquired the publication rights from Avalon Books to over 3,000 backlist titles predominantly in the Romance, Mystery and Western categories.

StockWinners is bearish on this name for the following reasons:

- AMZN reports their Q4 earnings after the close tonight, the options market is implying about a 8.6%* move following the results, which is a tad shy to the 4 qtr average of ~9.%. The stock has rallied on average ~10% (+6.87%, 7.87% & 15.75%) after the prior 3 qtrs. * With the stock trading at ~$270 the Feb1st weekly 270 straddle is offered at ~$23.40.AMZN recently made a new all-time high, but this new high was not as bullish a breakout as it might seem at first glance. First of all, it was made on relatively tepid volume, and on weakening momentum relative to AMZN’s initial push to new highs above 250 in September. Secondly, the immediate rejection of those new highs in the past two trading days might indicate an exhaustion of buying interest. The real test for the sellers though is around the $250 support level, which served as resistance in 2011 and 2012 on several occasions.

- This is a really low probability trade that is designed to place a directional trade to take advantage of high volatility around the earnings. The trade offers a 1:20 payoff which makes this trade's risk-reward ratio very attractive.

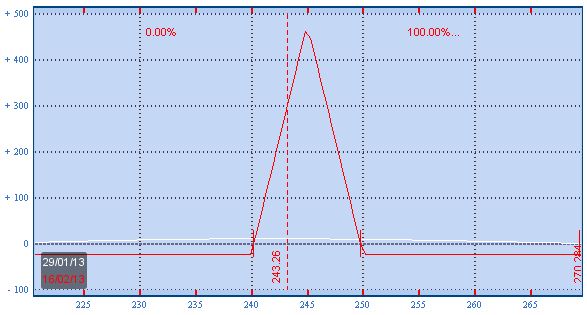

Trade: Buy 1 Feb $240/$245/$250 Put Butterfly for less than $.25

- Buy 1 Feb $250 Put for 5.50

- Sell 2 Feb $245 Put for 4.25

- Buy 1 Feb $240 Put fo 3.25

Breakeven & profit/loss analysis

- Breakeven at $249.75 and$240.25 by Feb expiration

- Profit up to $4.75 between $249.75 to $245 and $240.25

- lose up to $.25 between $240 to $240.25 and $250 to $249.75

The payoff graph is presented below:

Trade

- Buy 1 February $250.00 Put at $5.50

- Sell 2 February $245.00 Put at $4.25

- Buy 1 February $240.00 Put at $3.25

- For a net debit of $0.25

Profit/Loss Analysis

- Breakeven at $240.25 and $249.75

- Maximum profit is $475.00 at strike of $245.00

- Maximum loss is ($25.00) at strike of $250.00

Closing Summary

- Sold 1 February $250.00 Put at $2.13

- Bought 2 February $245.00 Put at $1.28

- Sold 1 February $240.00 Put at $0.80

|

|

Position closed on 2/4/2013 at price of $0.37 with a 48.00% gain in 6 days.

Updates

2/4/2013 2:57:17 PM

Hi there

Stockwinners is closing this trade. The position was established at $.25 and we are selling it for $.36. please adjust your stop loss if you decide you want to stay in this trade.