| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Outerwall (OUTR) provides automated retail solutions in the United States, Canada, Puerto Rico, Ireland, and the United Kingdom.

Outerwall (OUTR) provides automated retail solutions in the United States, Canada, Puerto Rico, Ireland, and the United Kingdom.

Its Redbox segment owns and operates approximately 43,700 self-service Redbox kiosks in 35,800 locations that enable consumers to rent or purchase movies and video games, as well as purchase event tickets.

The companys Coin segment owns and operates approximately 20,300 self-service coin-counting kiosks in 20,100 locations, which enable consumers to convert their coin to cash, a gift card, or an E-certificate.

Its New Ventures segment focuses on identifying, evaluating, building, and developing innovative self-service concepts in the automated retail space, which includes coffee, refurbished electronics, and photo self-service concepts. The companys kiosks are located primarily in supermarkets, drug stores, mass merchants, financial institutions, convenience stores, and restaurants.

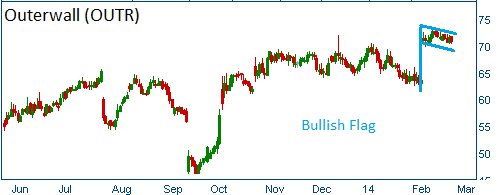

Shares have formed a bullish "flag" following the company's latest quarterly results. Higher share prices are expected for this stock.

52-Week Trading Range: $46.25 - $73.50

Last Trade: $70.58

Here is the trade:

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on OUTR call spread at $3.00.