| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Saks Incorporated (SKS) operates retail stores in the United States. Its stores offer an assortment of fashion apparel, shoes, accessories, jewelry, cosmetics, and gifts. The company operates stores under the brand name of Saks Fifth Avenue (SFA) that are principally free-standing stores in shopping destinations or anchor stores in upscale regional malls.

Saks Incorporated (SKS) operates retail stores in the United States. Its stores offer an assortment of fashion apparel, shoes, accessories, jewelry, cosmetics, and gifts. The company operates stores under the brand name of Saks Fifth Avenue (SFA) that are principally free-standing stores in shopping destinations or anchor stores in upscale regional malls.

It also operates Saks Fifth Avenue OFF 5TH (OFF 5TH) stores, which are primarily located in upscale mixed-use and off-price centers. As of September 05, 2012, the company operated 45 SFA stores; and 64 OFF 5TH stores.

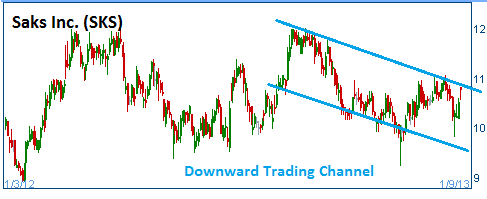

Shares have formed a downward trading channel. Presently, they are sitting at the upper boundary of the said channel. Lower prices are expected for this stock.

52-Week Trading Range: $8.92 - $12.14

Last Trade: $10.78

Here is the trade:

Buy One February $11 Put Option at $0.80 SKS130216P00011000

Sell One February $9 Put Option at $0.20 SKS130216P00009000

Net Investment: $0.60

Maximum profit $1.40 if stock closes at $9 by expiration date

Maximum loss $0.60 if stock closes above $11 by expiration date

Trade

Profit/Loss Analysis

Closing Summary

|

|