| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Ubiquiti Networks (UBNT) offers a portfolio of networking products and solutions for service providers and enterprises.

Ubiquiti Networks (UBNT) offers a portfolio of networking products and solutions for service providers and enterprises.

Its service provider product platforms provide carrier-class network infrastructure for fixed wireless broadband, wireless backhaul systems, and routing; and enterprise product platforms provide wireless LAN infrastructure, video surveillance products, and machine-to-machine communication components. The company offers high performance radios, antennas, software, communications protocols, and management tools that are designed to deliver carrier and enterprise class wireless broadband access and other services primarily in the unlicensed RF spectrum.

The company offers various technology platforms, including airMAX, which includes protocols that contain technologies for minimizing signal noise; EdgeMAX, a disruptive price-performance software and systems routing platform; and airFiber, a 24 GHz point-to-point radio system. It also provides UniFi, an enterprise Wi-Fi System that includes Wi-Fi certified hardware with software based management controller; AirCam H.264 megapixel IP cameras; airVision, a management controller software that are used to manage multiple airCam H.264 IP cameras as well as manage digital video recorder devices; and mFi, which comprises hardware sensors, power devices, and management software that allows devices to be monitored and controlled remotely via WiFi.

In addition, the company provides antenna products, as well as miscellaneous products, such as mounting brackets, cables, and power over Ethernet adapters. Ubiquiti Networks sells its products and solutions through a network of distributors, resellers, and original equipment manufacturers.

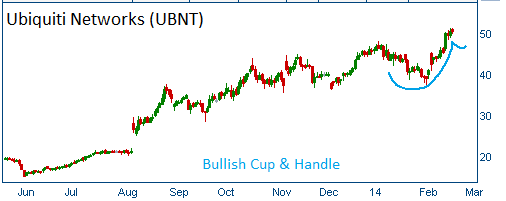

Shares have formed a bullish "cup & handle" and higher share prices are expected for this stock.

52-Week Trading Range: $12.76 - $51.22

Last Trade: $51.60

Here is the trade:

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on UBNT call spread at $3.50.