| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Gogo Inc. (GOGO) provides in-flight Internet connectivity and wireless in-cabin digital entertainment solutions in the United States and internationally.

Gogo Inc. (GOGO) provides in-flight Internet connectivity and wireless in-cabin digital entertainment solutions in the United States and internationally.

The company operates through Commercial Aviation and Business Aviation segments. The Commercial Aviation segment offers Gogo branded in-flight connectivity and wireless digital entertainment solutions to commercial airline passengers in the continental United States, including Alaska through its network of cell towers, airborne equipment, and air-to-ground spectrum.

The Business Aviation segment provides equipment for in-flight connectivity with voice and data services to the business aviation market. Its services comprise Gogo Biz, its in-flight broadband service, and satellite-based voice and data services through strategic alliances with satellite companies. This segment serves business aircraft manufacturers, owners, and operators, as well as government and military entities.

The company offers a suite of connectivity solutions and other services, including passenger connectivity, passenger entertainment, in-flight portal, and operations-oriented communications services. As of December 31, 2012, it had 1,811 commercial aircraft online.

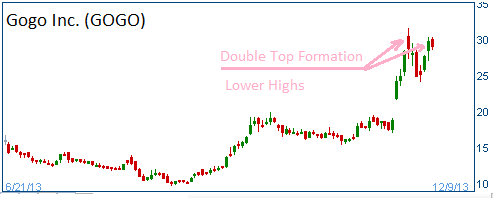

Shares of this recent IPO have moved higher on prospects of FCC allowing cell phone use on board flights. It appears that shares are forming a "double top." Note that shares were downgraded this morning.

JPMorgan downgraded Gogo (GOGO) from Overweight to Neutral with a price target of $28.00. Analyst Philip Cusick thinks upcoming, large lockup explorations could pressure the stock. 67% of outstanding shares will be freed up for sale when lockups expire on December 17th. In addition, Cusick thinks JetBlue's launch of Wi-Fi service could worry investors.

Trading Range Since IPO in Sep: $9.71 - $31.55

Last Trade: $29.00

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on GOGO trade.