| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Akorn, Inc. (AKRX) engages in the manufacture and marketing of diagnostic and therapeutic ophthalmic pharmaceuticals products, hospital drugs, and injectable pharmaceuticals in the United States and internationally.

Akorn, Inc. (AKRX) engages in the manufacture and marketing of diagnostic and therapeutic ophthalmic pharmaceuticals products, hospital drugs, and injectable pharmaceuticals in the United States and internationally.

It offers products in various specialty areas, including ophthalmology, antidotes, anti-infectives, pain management, anesthesia, and vaccines. The companys Ophthalmic segment markets diagnostic products, including mydriatics and cycloplegics, anesthetics, topical stains, gonioscopic solutions, angiography dyes, and others primarily for use in the office setting. This segment also offers therapeutic products, such as antibiotics, steroids, steroid combinations, glaucoma medications, decongestants/antihistamines, and anti-edema medications to wholesalers, chain drug stores, and other national account customers; and non-pharmaceutical products, which include various artificial tear solutions, preservative-free lubricating ointments, and eyelid cleansers.

In addition, the Ophthalmic segment provides a line of over-the-counter dry eye and other eye health products principally under the TheraTears brand name through a chain drug stores and big box retailers, as well as directly to optometrists, ophthalmologists, and other eye care practitioners and clinics. Its Hospital Drugs & Injectables segment provides a line of hospital drug and injectable pharmaceutical products comprising antidotes, anti-infectives, controlled substances for pain management and anesthesia, and other pharmaceutical products to hospitals through the wholesale distribution channel.

The companys Contract Services segment manufactures ophthalmic and injectable pharmaceutical products for third party pharmaceutical customers based on their specifications. It serves physicians, optometrists, hospitals, wholesalers, group purchasing organizations, retail pharmacy chains, and other pharmaceutical companies.

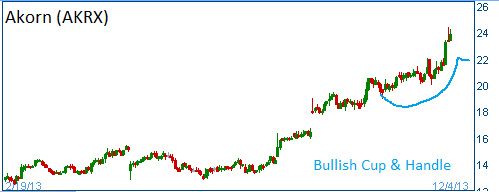

Shares have formed a bullish "cup & handle" adn higher share prices are expected.

52-Week Trading Range: $23.39 - $24.22

Last Trade: $23.85

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on AKRX trade.