| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Jabil Circuit (JBL) provides electronic manufacturing services and solutions worldwide.

Jabil Circuit (JBL) provides electronic manufacturing services and solutions worldwide.

The company operates in three segments: Diversified Manufacturing Services, Enterprise & Infrastructure, and High Velocity Systems. It offers electronics design, production, and product management services to companies in the aerospace, automotive, computing, consumer, defense, healthcare, industrial, instrumentation, medical, networking, packaging, peripherals, solar, storage, and telecommunications industries.

The companys services include integrated design and engineering; component selection, sourcing, and procurement; automated assembly; design and implementation of product testing; parallel global production; enclosure services; systems assembly, direct order fulfillment, and configure-to-order; and injection molding, metal, plastics, precision machining, and automation services.

It also provides mobility, display, set-top boxes, and peripheral products, such as printers and point of sale terminals; and aftermarket services consisting of warranty and repair services.

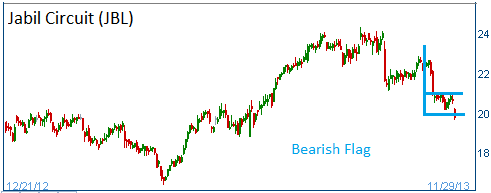

Shares have formed a bearish flag after the firm warned of lower earnings. Last night's poor quarterly results from Cisco Systems (CSCO) did little to help JBL since Jabil is a contract manufacturer for Cisco. Lower share prices are expected for JBL.

52-Week Trading Range: $16.39 - $24.32

Last Trade: $19.82

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on JBL put option.