| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Commercial Metals Company (CMC) manufactures, recycles, and markets steel and metal products, and related materials and services in the United States and internationally.

Commercial Metals Company (CMC) manufactures, recycles, and markets steel and metal products, and related materials and services in the United States and internationally.

The company's Americas Recycling segment processes scrap metals for use as a raw material by manufacturers of new metal products through 31 scrap metal processing facilities to steel mills and foundries, aluminum sheet and ingot manufacturers, brass and bronze ingot makers, copper refineries and mills, secondary lead smelters, specialty steel mills, high temperature alloy manufacturers, and other consumers.

Its Americas Mills segment operates 5 steel mills that produce reinforcing bars, angles, flats, rounds, small beams, fence-post sections, and other shapes; 2 scrap metal shredder and processing facilities; and a railroad salvage company. The company's Americas Fabrication segment operates rebar and structural fabrication, fence post manufacturing plants, construction-related product facilities, and plants that bend, cut, weld, and fabricate steel; warehouses that sell or rent products for the installation of concrete; plants that produce steel fence posts; and plants that heat-treat steel.

Its International Mill segment is engaged in mill, recycling, and fabrication operations through 2 rolling mini mills that produce reinforcing bar and merchant products; a specialty rod finishing mill; scrap processing facilities that support the mini mills; and 4 steel fabrication plants for reinforcing bar and mesh products.

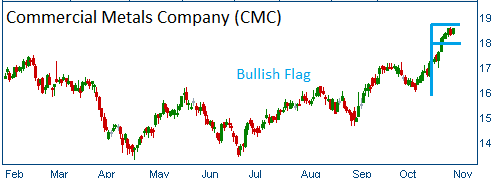

Shares have formed a bullish "flag" following the company's better than expected quarterly report. Higher share prices are expected for this stock.

We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares.

52-Week Trading Range: $12.91 - $18.60

Entry Point: $18.57

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are taking profits on CMC trade.